MasterSoft’s HRMS Software for Higher Education Institutes

MasterSoft’s online HR management software is a robust ERP software that has been developed to simplify and improve all HR-related activities of an organisation. Higher educational institutes can utilise the software to manage key operations such as staff recruitment, administration, training of faculty and hiring.

The HR management system ensures productive workflow and systematic paroll by auto-calculating salaries. It facilitates timely communication across different departments, increasing productivity and accurate decision-making.

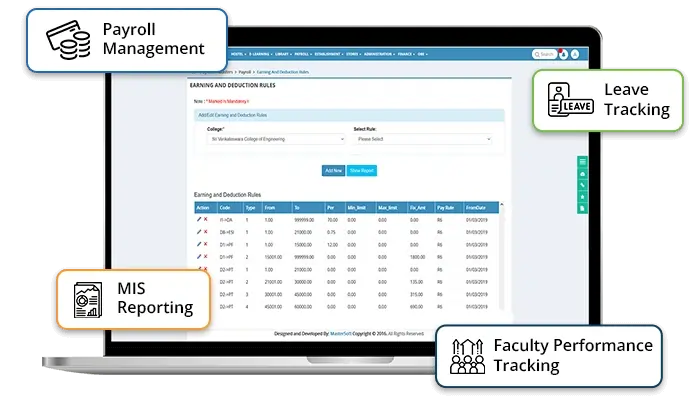

Payroll Management System

Streamlined operations of core institutional processes are key to institutional success, which becomes difficult without proper mechanisms. Moving beyond traditional approaches and leveraging a robust resource management system ensures high productivity and efficiency.

That is where the human resource management system proves to be an ideal tech solution that accelerates the daily functionalities of an institute. It reduces manual data entry and paperwork and enhances overall organisational efficiency.

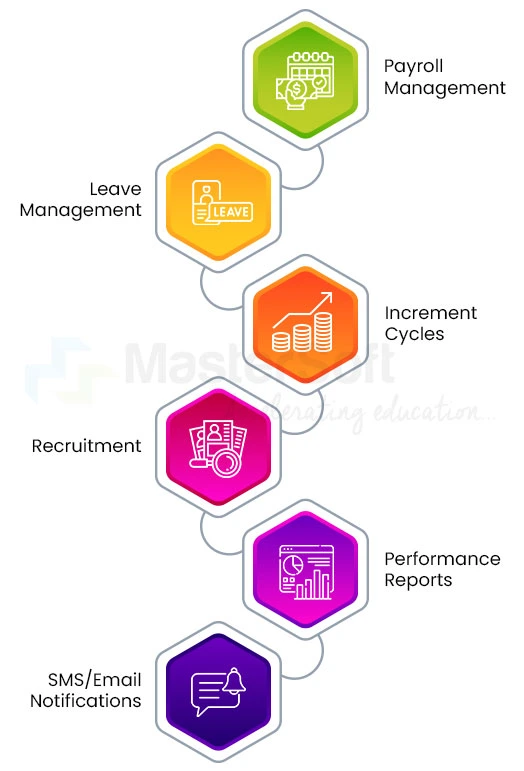

Key Features of MasterSoft’s HRMS Software

1 Payroll Management

MasterSoft’s HRMS software streamlines the payroll of educational institutes by automating salary calculations and tax deductions. Furthermore, it supports interoperability with leave and attendance management systems, which helps to compute salaries and facilitate error-free payroll management.

2 Online Recruitment Provision

Institutes can automate the end-to-end hiring process with the help of the tool, which helps to post the job details across several platforms. Furthermore, the system simplifies resume screening, shortlisting, and interview scheduling.

3Service Book Module Integration

The software service book module centralises staff and faculty’s work history, including appointments, promotions, transfers, increments, leaves, disciplinary actions, etc. Institute management or leaders can generate performance reports, helping them gain insights into employees’ work consistency and contribution.

4Smart MIS Report

MasterSoft’s HRMS generates MIS reports on central HR metrics such as attendance, payroll, performance, recruitment, training, and employee engagement.

5Easy-To-Use Interface

The tool’s easy-to-use interface ensures a smooth and hassle-free experience, allowing the admin staff to access key information effectively.

6Faculty Performance Tracking

Institutes can set up KPIs (Key Performance Indicators) like teaching effectiveness, research contributions, attendance, student feedback, etc. Institute management or leaders can collect data and track ongoing progress on all of the KPIs and determine faculty’s contribution and performance.

MasterSoft’s HRMS Software for Higher Education Institutes

Streamline the entire payroll process at educational institutions using this payroll management software as a digital solution. This software completely automates the payroll processing tasks for schools, colleges, universities and other educational institutions, such as salary calculations, leave management, taxes, etc. Make HR and administrative tasks extremely efficient and eliminate the risk of errors with this advanced digital platform.

Efficient and precise salary processing are the hallmarks of an ideal payroll management system. Calculate employee benefits, such as paid leaves, compensations, benefits, appraisals, etc., automatically with this digital platform. Keep accurate financial and salary records and follow government regulations at all times using this excellent payroll management system.

MasterSoft HR & Payroll Management System makes it extremely easy to perform administrative tasks. Effectively streamline record-keeping for the HR and administrative departments in educational institutions. Automate all payroll-related tasks for maximum efficiency and accuracy. Ensure optimal administration and errorless financial record-keeping at schools, colleges, and universities with these digital solutions by MasterSoft.

Easily integrate these advanced HR and payroll management software systems with existing faculty management systems to ensure an efficient online staff recruitment process. The administrative department can use this software solution to post job vacancy notices, filter eligible candidates with several filtering options, and control the overall vacancy management more efficiently.

MasterSoft HR & payroll management software systems are powered by in-built BI and have integrated AI-powered analytics dashboards. These high-tech features let school and college administrators track individual employee performance at any time. Generate reports based on daily, weekly, monthly, and yearly periods. Accuracy and reliability during appraisals, which ensures transparency in financial reporting are achievable using this advanced software solution.

Overall, MasterSoft HR & Payroll Management Systems are comprehensive digital solutions for efficiently managing staff, faculty, and other employees in educational institutions, especially those with Multi-Academy Trusts (MATs).

Components of Human Resources Management System (HRMS)

The primary function of HRMS is to automate HR-related activities and improve organizational efficiency through the following components:

Application Management

Institutes can post faculty job posts and track and monitor candidates’ applications through HRMS’s employee onboarding module. The system’s single interface simplifies the hiring process by organising the screening, shortlisting, and interview processes. Selected candidates can complete the onboarding process by uploading the necessary documents digitally.

Employee Management

The software’s centralised platform stores employee information such as work history, attendance, payroll, performance evaluations, etc., in a unified database. Self-service portals allow employees to update their personal details, apply for leave of absence, and help institute management keep track of staff productivity and monitor engagement levels.

Organisational Management

The software establishes a systematic and structured system, wherein the institute’s management can define reporting structures and departmental roles. The maintenance and update of institute policies and employee contracts ensure voluntary compliance, improved work management, and reduced administrative burden.

Payroll Management

Ensures timely payment of salaries as the software streamlines the payroll process through automated salary calculations and tax deductions. Furthermore, the integration of HRMS with attendance and leave management systems leads to the accurate calculation of salaries based on overtime, working hours, and deductions.

Employee Performance Management

The software supports real-time employee performance tracking and helps the HR or institute management to establish Key Performance Indicators (KPIs). They can track employee progress and gain insights into employee performance through comprehensive quarterly and yearly reports.

Attendance Management

Provides an automated attendance management system that tracks time and accurate work-hour calculations while reducing manual errors. Integrating the software with RFID scanners and biometric systems enables employees to clock in and out conveniently. Also, staff and faculty can use the system to apply for leave and check attendance trends.

Benefits Management

The system has several built-in features that allow institutes to manage, define, and customise organisation-specific benefits. For instance, they can include bonuses, paid leaves, wellness incentives, etc.; the institute management can track and examine financial data. This helps to allocate resources accordingly and optimise benefits management.

Graphical Reports and Analytics

Graphical reports and analytics enable institute management to get comprehensive insights into core operations such as employee attendance, payroll, performance, etc. In effect, they can develop appropriate strategies and make data-driven decisions to meet organisational requirements.

How Do Payroll Management Software Work?

MasterSoft's HR management software solution comes with a super-advanced AI-powered Application Tracking System (ATS). Startups and high-performance SMBs can use this recruitment management software. Automate your talent acquisition process and make it easier to keep track of individual applicants throughout the recruitment process using this cutting-edge HR management solution by MasterSoft ERP.

Pre-Payroll

Collaboration becomes efficient between HR and payroll departments for recruitment management, and payroll grade allotments become easier.

Actual Payroll

Simplify entering employee data into the payroll system and ensure optimal accuracy to avoid errors in financial record-keeping. Accurately calculate employee net pay after considering all applicable taxes and other deductions.

Post Payroll

Ensure accurate payroll processing by automatically taking care of all deductions, such as Tax Deductions at Source (TDS), Employee Provident Fund (EPF), and Employee State Insurance (EPI). Transfer relevant deductions to the appropriate government agency more efficiently.

Optimize Human Resource Management

Call to Schedule a Free Demo Now!

Request Demo

Benefits Of Payroll Management System

Holistic Approach

Monitor All Employee Activities In Real-Time

Optimal Business-Grade Solution

Ai-Powered Reporting And Analytics Dashboard

Integrated System

Automates All Payroll Tasks

Increases Data Security

Swift Salary Calculation And Payment

Value for Money

Minimal Implementation Costs

Affordable And Comprehensive HR Software

24/7 System-Powered Assistance

Reports Generated

- Salary Bill Register

- Payslip and Salary certificate

- LIC List With Policy Details

- Schedule PT, GPF, Income Tax, Etc.

- Monthly Installment Report

- Salary Abstract/Breakdown

- Bank Statement

- Supplementary Bill Register

- PF Register

- PF Loan Sanction Statement

- PF Broadsheet

- PF Final Settlement Report

- Annual Group & Individual Employee Report

- Form 16 And Form 24Q

- Declaration Form

- Single/Multiple Head List Selection

- Employee ID Card

- Chosen Field Of Employee

- Annual Report for all & individual Employee

- Form 16 and Form 24Q

- Declaration Form

- Selected Single head or Multiple head List

- Employee Id card

- Selected field of employee

Cloud-Enabled Human Resource Management System

Cloud-enabled HRMS software is an ideal solution with higher scalability that ensures administrative efficiency and modern functionalities such as:

Real-Time Analytics

Institute team members can get real-time reports on employee attendance, payroll, and performance, enabling them to identify frequent absenteeism and other issues. Besides, customisable reports and interactive dashboards enable them to improve workforce planning and resource allocation.

Intelligent Application

Cloud-enabled HRMS software utilises automation, artificial intelligence (AI), and real-time analytics to improve major HR-related processes. Institutions can track productivity trends and implement appropriate strategic methods.

Improved Employee Engagement

The system promotes transparency, cross-departmental communication, and accurate reporting through data-driven operations. Furthermore, the integration of engagement analytics, AI-driven feedback tools, etc., helps to measure employee engagement and maintain a positive workplace environment.

Data Security and Privacy Control

Advanced data security, such as encryption mechanisms, protects data from unauthorised access and cyber threats. Role-based access is a privacy control measure that allows authorised stakeholders to access data with valid credentials and passwords.

Predictive Analytics

Predictive analytics in cloud-enabled HRMS software utilise AI and machine learning, helping institutes forecast employee activities such as low attendance rates and underwhelming academic performance. Thus, institutes can develop and implement specific preventative measures to overcome concerning issues.

Improved Recruitment Process

Educational institutes can implement an improved recruitment process with the help of the cloud-enabled tool, as AI-driven technology accelerates the hiring process and facilitates a seamless candidate experience.

Why is HRMS important for your institution?

Organised human resource management activities are important for the organisational workflow of an institute; HRMS software facilitates effective workforce management and the following benefits:

Simplifies Attendance Management

It replaces the paper-based attendance-taking system and enables faculty and staff to mark themselves as present. Integration of the software with biometric systems, RFID cards, and mobile applications ensures accurate attendance logging and prevents manual errors.

Improves Training and Development

Institutes can incorporate e-learning tools and enhance employee training and development through self-paced learning modules. Furthermore, the tool helps to track assessment scores and training completion and administer flexible employee training sessions.

Improves Communication

Common communication platforms allow staff and faculty to communicate with each other, and instant messaging, automated notifications, and self-service portals provide timely updates. Employees can collaborate efficiently, improving engagement and reducing misunderstandings.

Help Faculty to Perform Better

The software automates time-consuming administrative activities, allowing faculty to focus on teaching and learning activities. It generates performance evaluation reports through student feedback, peer reviews, and KPI tracking, helping to provide detailed insights and adapt their instructional activities accordingly.

Improves the Query Handling Process

The tool can integrate with AI-powered chatbots and self-service portals, providing a structured mechanism to answer queries in real time. Also, it stores the queries, helping the institute management to identify common issues and implement strategic measures.

HRMS Security

Digitalisation of institutional data replaces the traditional or manual method of storing data; however, ineffective security mechanisms can lead to data breaches/theft. Fortunately, HRMS software utilises robust security measures like multi-factor authentication and role-based access controls, protecting sensitive institutional information effectively.

Frequently Asked Questions (FAQs)

HR management in educational institutes encompasses a host of activities such as recruitment, onboarding, payroll, benefits administration, performance management, and professional development.

The HRMS software automates day-to-day human resource activities and offers the following benefits:

- Streamline daily HR processes.

- Automates attendance management

- Enhances institutional productivity

- Offers analytical reports on core institutional operations.

- What are the essential features of the HRMS software?

The following are the key features that institutes must look for while selecting HRMS software for their institution.

- Centralised faculty & staff database

- Automation of daily HR tasks

- Analytics & MIS reports

- Faculty leave management

- Easy-to-use interface

Choosing the right HRMS can be challenging, especially without a proper plan; therefore, the following steps can be useful in selecting a suitable HRMS:

- Assess the institute's requirements and HR challenges.

- Figure out the basic HR tasks that need automation.

- Set the budget.

- Compare ERP vendor performance

- Get product demos from different vendors.

- Check for customisation and post-implementation support.

- Make the final choice.

The main functions of an efficient payroll management system are:

- Salary And Compensation Structuring

- Defining Leaves And Salary Deductions

- Salary Calculation And Wage Processing

- Managing Payroll Taxes

- Filing Tax Returns

- Generating Tax Filings And Analytical Reports

A payroll management system should be affordable and also provide comprehensive management features that are required for efficient payroll processing. The payroll management solution should be customizable to include different parameters for leave, wage deductions, and other aspects of automated payroll calculation. Additionally, the system should have optimal data security features to keep employee data safe.

The following list depicts the best benefits of a payroll management system.-

- Automating Payroll Tasks

- Precise Payroll Calculations

- Cost-Effective And Efficiency-Enhancing

- Comprehensive Data Security Features

- Error-Free Salary Calculation

- Pay-Slip Generation